How to Prepare for Startup Offer Negotiations: A 3-Step Playbook

How to translate competing offers into informed, thoughtful conversations

🤝 Apply now for invites to our curated happy hours in NYC (11/5) and SF where we’ll bring together standout engineers and top founders for drinks, bites, and great conversations. In two weeks, meet founders from Crosby AI, Blacksmith, Traversal, and more in NYC.

The spectacular moment arrives…you receive an offer from a startup you’re excited about. There’s just one problem: the numbers feel off. Maybe you’re being lowballed, or maybe you just don’t have enough context. Now what?

After last week’s SF Founders You Should Know showcase, many of you might find some offers in your inbox in the coming months. If you’re weighing a startup offer against a big tech one, the comparison can be especially tricky.

Here’s the thing: founders and their recruiters have entire networks of VCs, partners, and fellow founders to help them stay on top of market rates (and pay to subscribe to tools that help with this, too). You probably don’t have that same advantage; your benchmarking might be limited to asking a handful of friends what they make.

So how can you level the playing field and negotiate effectively despite this information asymmetry? How can you understand how your early-stage equity offer compares to RSUs at a larger company? Most importantly, how do you translate your big tech offer into meaningful negotiation leverage with a startup?

FYSK’s very own show emcee and startup connoisseur David King (DK) has been helping our community members navigate these exact questions for years. Here are the three steps he recommends everyone take to prepare for getting your startup offer where you want it:

1. Write down your assumptions

At larger tech companies, outcomes related to your compensation package are more or less predictable. RSUs at firms like Google behave (almost) like cash, offering a steady value over time. In contrast, smaller startup offers lean heavily on equity, trading predictability for your potential upside. This makes it difficult to compare offers directly against cash-focused packages at big tech. So how can you compare them?

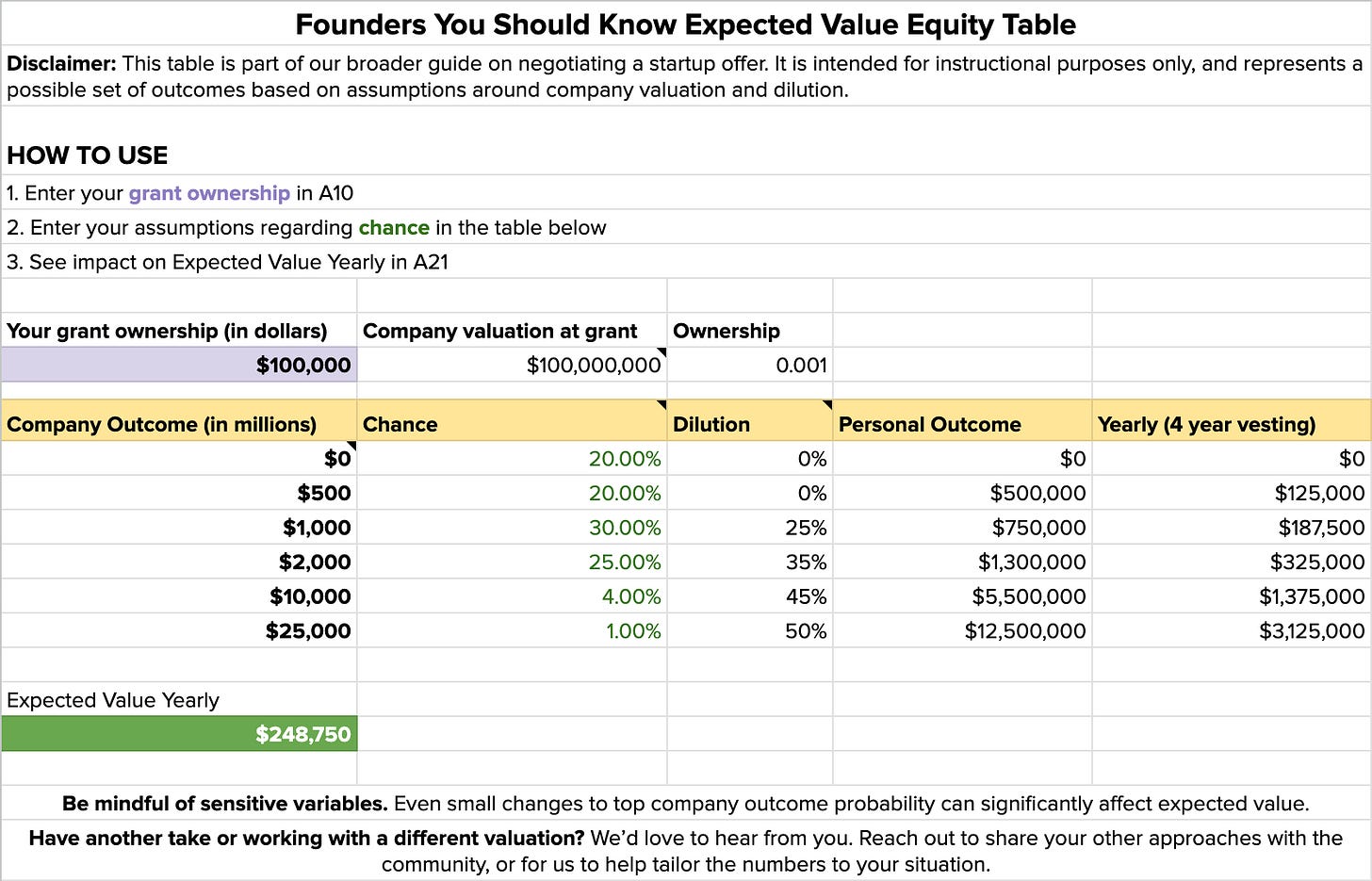

Here’s DK’s recommendation: build an expected-value table (like the one below) based on your assumptions about the startup to help compare your offers. This will help rationalize decisions you make and anchor your financial expectations.

If the startup is currently valued at $1 billion, and you’re offered a $100K equity package, what could that package be worth in different scenarios? At what valuation and probability does it become a “no-brainer”? How likely is a successful acquisition, and what would it mean for your stake?

We’ve prepared a customizable EV table for valuations around $100M to help walk you through this process; just enter your assumptions based on the instructions and see how that impacts your expected yearly value.

A quick caveat: This approach treats startup equity as a math problem you can model with probabilities and scenarios. Ultimately, the assumptions in this table are just that—assumptions. It’s useful for those who want structure around an inherently uncertain decision, but it’s not the only way, or necessarily the best way for you, to think about your career.

We recommend using this spreadsheet as a guide to clarify your thinking and support conversations with your network and hiring manager. This won’t give you “the answer,” but it can help organize your thinking if numerical models resonate with how you make decisions.

Answering these questions will also help prepare you for the next step: the “temp check”.

2. Temp check

Once you’ve quantified your assumptions, test them. Bring in a friend or two and ask: “Does this sound crazy?” or “Am I being too optimistic?” This reality check can reveal blind spots and help ground your decision-making.

Use the structure of a spreadsheet to your advantage; this tool turns vague hunches into concrete assumptions that others can challenge effectively. Friends, peers, or mentors can offer perspective you might miss on your own about overly optimistic assumptions or insight from their own journeys. Feedback from voices you trust can turns a personal decision into a collective process, which can crystalize your thinking and help you approach your negotiation with greater confidence.

We see this all the time at Founders You Should Know — jobseekers turn to the community to chat through their assumptions, breakdown their offer, and crystalize what best next steps look like. When you join our community today, you’ll be connected with 2000+ engineers and operators that can help you chat through your decision making.

3. The negotiation

Your startup might have a reasonable chance of delivering an extra $100K or $150K over five years, but a big-tech offer could guarantee $200K in cash compensation through RSUs.

You want to use the inherent variability of startup outcomes to your advantage in negotiation. This might look like:

“This is a great company I’d like to be a part of, but I need to be rational here. I have a competing offer guaranteeing $200K in cash. When I model out reasonable scenarios for the equity in my offer, even optimistic ones, there’s a meaningful gap I’d be taking on as risk.

I’m open to that risk for the right opportunity and team, but the equity here would need to be larger to make the rationale work for me. I’d like to open a discussion on how we can bridge this gap.”

Important: The above models are a tool for you, not a negotiating document. Sharing exact calculations with recruiters typically backfires: it can seem presumptuous or reduce complex negotiations to a pure numbers game. Keep your analysis private and use it to inform confident, well-reasoned asks in your actual conversations.

Having already explored the potential financial outcomes and tested your assumptions with others, you can approach this conversation with clarity and confidence.

This piece takes inspiration from friend of FYSK Yan-David (Yanda) Erlich’s comprehensive 2020 article on navigating early stage equity; the advice in this article adapts Yanda’s concepts based on conversations we’ve had with our community and applies these concepts to negotiation.